27 january 2025

The new rules in 1.5 minutes

There are new pension rules in the Netherlands. Curious about what will change and what will stay the same? You will be up to speed in just 1.5 minutes.

Agreements on the new pension scheme

PME will switch to a new pension scheme as well. We aim to switch on 1 January 2027, a year later than previously stated. Employers and employees have made arrangements about the new scheme we will then get. Want to know what this means for you? Read on and sign up for the webinar.

Your pension in 2025

A number of things will change for your pension in 2025. The maximum salary on which you accrue pension will be 95,236 euros in 2025 (this was 89,382 euros in 2024). And the part of your salary on which you cannot accrue any pension (the offset) will increase to 18,475 euros (this was 17,545 euros in 2024).

Your accrued pension increased by 0.3 percent

Each year, PME’s Board considers whether the fund is in a position to increase pensions. This depends on our financial position and the rules we have to follow. Everyone who has a pension with PME, receives an increase of 0.3 percent as of 1 January 2025. Based on the current rules, this was the most we could do.

How PME is doing financially

Our funding ratio increased in the 4th quarter of 2024. The funding ratio indicates whether we have enough cash to pay every pension, now and in the future.

Factor A: found just like that!

Do you have an annuity insurance policy or a bank savings arrangement for your pension? Then you will need the Factor A for your tax return. This indicates how much pension you have accrued in one calendar year. For the 2024 tax return, use the Factor A from 2023. You will find this on your 2023 Uniform Pension Statement (UPS). Log into our website and go to Documents.

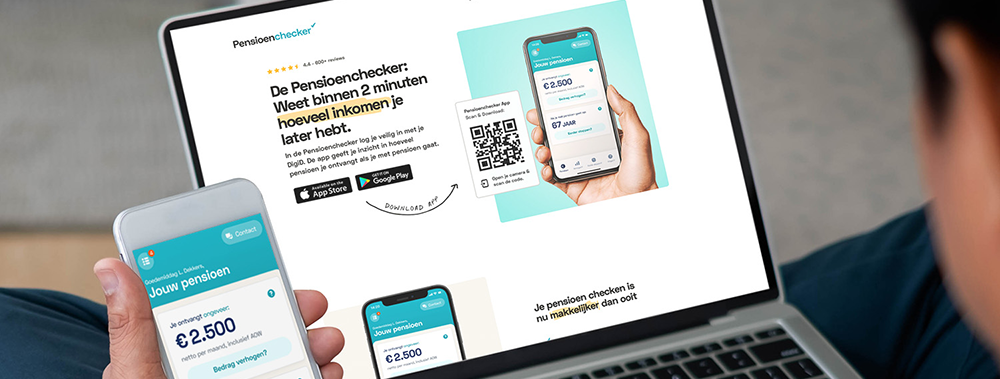

Check your pension like your bank balance

Check your pension as easily as your bank balance. That’s the idea behind the Pension Checker. This free app shows you how much pension you will receive later (in Dutch). It also shows whether you can retire early. Try the app right away!

We are here for you

Got a question about your pension? We will be happy to help you. You can reach us on any business day between 8 a.m. and 5 p.m. Call 088 194 70 01, chat with us or email deelnemer@pmepensioen.nl.